What's New -April 2024

Posted Tuesday, April 2, 2024

Sales

F&I Tab- Two new fields in the F&I Tab aimed at enhancing dealers' funding tracking capabilities: 'Deal Package Submitted Date' and 'Funding Notes'. Now, your finance or accounting team can easily post notes and monitor fundings starting from the moment the deal package is sent to the lender.

In the Buyer Tab- The Customer Deposit section will now exclude any prior payments received from the same customers if the payment dates are older than 90 days. This adjustment ensures that payments appearing in the 'Other Related Deposits' section aren't assumed to be automatically associated with a specific sale, as they might be related to multiple transactions and not solely attributed to one.

Bookeeping

Collection Screen-While it's optimal for collectors and management to utilize the Collection Tab for viewing and auditing collection progress, users exporting the list via the green export button (located at the top-right-hand side of the list) will now find that it includes 'LastTextSent'.

Inventory

Automated Pricing Rule Feature has an added functionality: 'Purchase Cost' for Field 2. Set it to this field so that dealers can now adjust sales or asking prices based on the actual purchase cost, excluding Recon or Pack. This enhancement could be particularly beneficial for dealers who primarily sell new cars or have minimal expenses in Recon.

When adding a new stock for a prior VIN that you had in stock and sold before, any vehicle disclosures will automatically transfer to the new stock number for the same VIN.

Reports

Sales- Unfunded Deals Report- when viewed in Drill Down mode, you'll now find additional details such as the deal package sent date and funding notes, as previously mentioned in the F&I Tab. This enhancement offers a comprehensive view for improved funding tracking and helps determine the cause of any delays.

Custom Reports- Several new fields have been added, including 'DaysSinceLastSalePriceChange' and 'DaysSinceLastAskingPriceChange', for the 'Unsold Vehicles' report source. Additionally, the new 'Funding Submitted Date' is now available for the 'Sales List' report source.

NC Dealers- MVR63 POA will print one copy per each buyer and it will no longer print them as combo on the same POA. Furthermore, MVR 614 is updated to the newest version.

Jacket Stickers Part II will now not display commissions for users who lack access to the Recap tab. Similarly, if a user doesn't have access to view the purchase cost in the Edit Inventory screen, the purchase cost will not be shown.

Shop

For shops preferring to set part costs as zero instead of using cost markup in the Part Management Tab, you can utilize the following steps: set line 6 to establish the price, and then set line 7 to 0.01 as the selling price. This will display 0 for the part's sold price when loaded into the RO, indicating to the system that there's no change to the customer. This feature proves useful in scenarios where parts are included in a kit or negotiated at a set charge.

RO Kits- you can now create a Kit using a Flat Labor Rate. A FAQ is available to guide you through the steps required to add this new feature, allowing you to input either the number of hours or the flat price of a labor item when creating a kit. When you add the kit to an RO, the number of hours is reverse-calculated.

WIP Tab- When hovering the mouse over the total RO amount based on the selected filters, you will now see only part sales information. This provides a quick snapshot of parts sold, excluding fees or labor items, which can be useful for rapid assessment.

CRM

Vehicle Overlays- There is a new feature available in ASN CRM that enhances your vehicle presentation capabilities! Now, users can customize Vehicle Image Borders/Overlays, in addition to the existing background remover feature.

Accessing this feature is simple. Just navigate to CRM -> Settings -> Other Settings -> Vehicle Image Borders/Overlays.

With this new feature, you have the flexibility to apply special overlays or utilize the ones provided by the system. You can opt to apply them to specific stock numbers or to all vehicles in your inventory. We've also included a convenient functionality: selecting a vehicle tag from the AutoDealer Plus inventory page and applying the border/overlay to only those vehicles where the tag was also assigned to the layer name.

This means you can tailor your vehicle presentations to specific scenarios. For instance, if you have vehicles marked as "Coming Soon," you can utilize this feature to assign a unique overlay. Similarly, for special sales offerings, you can easily highlight specific vehicles with distinct overlays.

We believe this enhancement will further empower you to create visually captivating vehicle listings, enhancing customer engagement and boosting sales. Inventory Feeds will include image with the borders/overlays.

ASN Websites

ASN Website Manager- The payment calculator now offers new features, allowing you to accurately generate payment estimates for vehicles or RVs. The default settings enable you to customize payment selections and offerings for your customers on ASN Websites.

Highlights:

If ASN manages your inventory feed, it's advisable to periodically audit the inventory feed list to ensure you maintain valid and beneficial relationships with these vendors. Should you need to discontinue a feed, you can easily manage it through DealerZone. Simply navigate to 'Other' and click on the tile labeled 'Inventory Uploads' to access your current Outgoing Feeds. From there, you can click to edit and remove existing feeds, or use the 'Add New' button to include a new source for receiving your inventory. This streamlined process offers the most effective way to manage your inventory feed, eliminating the need for emails, calls, or interactions with TSMs.

Amazon Web Services (AWS), Google, Microsoft Azure, and other cloud hosting providers may experience occasional downtime. These interruptions can impact the ASN interface, including services such as AutoCheck, KBB, RouteOne, VinAudit, 700Credit, F&I Express, and others. It's important to note that while your team may assume these interruptions are due to software breakdowns, this is not always the case. In most instances, you might encounter messages stating that the server cannot be reached or is unresponsive, prompting you to wait and retry. Please assist in informing your sales and other team members, as some may be initiating multiple TSMs or calls in anticipation of ASN resolving these unforeseen issues. Although they are rare, it's essential to clarify this matter to all concerned parties.

Latest Update is Version 7.0.17.54

Motivational Marketing Strategies for Used Car Dealers

Posted Monday, April 1, 2024

Introduction: In the fast-paced world of used car sales, staying ahead of the competition requires more than just offering quality vehicles. It demands strategic marketing that inspires both your team and your customers. As a used car dealer, your success hinges not only on the cars you sell but also on the marketing strategies you employ. In this article, we'll explore some motivational marketing techniques to help you rev up your sales and drive your dealership towards success.

-

Know Your Audience: Understanding your target market is the first step towards effective marketing. Analyze the demographics, preferences, and buying behaviors of your potential customers. Are they young professionals looking for fuel-efficient cars, families in need of spacious SUVs, or enthusiasts seeking classic models? Tailor your marketing messages and advertising channels to resonate with your audience.

-

Highlight Unique Selling Points: Set your dealership apart by showcasing what makes you unique. Whether it's a wide selection of certified pre-owned vehicles, competitive pricing, excellent customer service, or special financing options, emphasize your strengths in your marketing materials. Highlighting your unique selling points instills confidence in customers and encourages them to choose your dealership over others.

-

Leverage Digital Marketing: In today's digital age, having a strong online presence is essential for reaching potential buyers. Utilize social media platforms, such as Facebook, Instagram, and Twitter, to engage with your audience, share updates on new arrivals, and promote special deals. Invest in search engine optimization (SEO) to ensure your website ranks high in search results when customers are looking for used cars in your area.

-

Harness the Power of Visuals: Pictures speak louder than words, especially in the automotive industry. Invest in professional photography and videography to showcase your inventory in the best light possible. High-quality images and videos not only attract customers but also build credibility and trust. Consider creating virtual tours or live streams to give potential buyers a closer look at your vehicles.

-

Foster Customer Relationships: Building long-lasting relationships with your customers is key to sustaining success in the competitive used car market. Implement customer relationship management (CRM) systems to keep track of interactions, follow-ups, and feedback. Personalize your communications and show appreciation for their business through loyalty programs, exclusive offers, and personalized discounts.

-

Encourage Word-of-Mouth Referrals: Satisfied customers can be your most powerful marketing tool. Encourage positive word-of-mouth by delivering exceptional service and exceeding expectations at every touchpoint. Offer incentives, such as referral discounts or free services, to encourage existing customers to recommend your dealership to their friends and family.

-

Stay Agile and Adapt: The automotive industry is constantly evolving, and so should your marketing strategies. Stay informed about industry trends, consumer preferences, and emerging technologies. Be willing to adapt and experiment with new marketing tactics to stay ahead of the curve and remain competitive in the market.

Conclusion: As a used car dealer, your marketing efforts play a crucial role in driving sales and growing your business. By understanding your audience, highlighting your unique selling points, leveraging digital marketing channels, showcasing your inventory visually, fostering customer relationships, encouraging referrals, and staying agile, you can create a winning marketing strategy that motivates your team and attracts customers to your dealership. So rev up your engines, implement these motivational marketing techniques, and watch your dealership accelerate towards success!

Source: ASN-GPT

U.S. Senators File Recall Legislation

Posted Monday, April 1, 2024

Three U.S. senators filed a bill that would require car dealers to repair any outstanding safety recall on used cars before selling, leasing or loaning them to customers.

Richard Blumenthal (D-CT), Edward Markey (D-MA) and Elizabeth Warren (D-MA) filed the bill.

“Whether a car is brand new or used, nobody should be at risk of purchasing an unsafe car,” Markey said in a press release. “And it doesn’t matter if a car is still on the lot or in a driveway, it needs to be made safe.”

The bill specifically addresses safety recalls. According to Blumenthal’s press release on the bill, manufacturers will be required to provide dealers with parts to make the necessary repairs within 60 days or reimburse the dealers.

The bill does provide exceptions, including recall information not being available at the time of the sale, vehicles being sold at wholesale and vehicles being sold as junk.

According to a National Highway Traffic Safety Administration report issued earlier this month, the agency issued 1,000 recalls for vehicles, car seats, tires, RVs and other equipment in 2023. Nearly 35 million vehicles were recalled in 2023.

Source: Usedcarnews

4 Ways AI Can Be Leveraged in the Automotive Aftermarket

Posted Monday, April 1, 2024

We are witnessing a transformative era similar to what we felt when the internet emerged, and how we shop changed forever.

Artificial Intelligence (AI) promises to unlock the true potential of the massive amounts of data that the automotive aftermarket industry (retailers, manufacturers, and distributors) have at their disposal.

However, to fully realize its benefits, we must navigate the challenges of data management, quality, and relevance. To quote Phil Le-Brun, an AWS enterprise strategist and evangelist, “The boldest house built on dodgy foundations will not last. The same is true in the world of machine learning (ML). With generative AI, quality trumps the quantity of business data available.”

Most of us in the automotive aftermarket industry have too much or too little data — we are still trying to master our data management, and now Generative AI has joined the dinner table.

The Rise of AI

AI promises to harness the potential of the massive data available to the automotive aftermarket industry. It is grounded in advanced machine learning and deep learning techniques and offers the capacity to analyze historical data and generate valuable insights and solutions from the extensive data collected by automotive retailers, manufacturers, and distributors.

This shift isn’t just about data analysis; it’s about creating enhanced value for the automotive aftermarket industry and our customers.

Here are four ways a forward-thinking approach to AI will allow automotive and heavy-duty companies to expedite their data journey and redefine the way we provide more meaningful and frictionless experiences for our customers:

Establishing a Strong Data Foundation

While it’s common to talk about the two words no senior leader wants to hear—technology debt—we need to acknowledge the possibility that we are all guilty of having data debt or dark data. This typically stems from a lack of data quality, fragmented or siloed data sources, a lack of data literacy, inadequate upfront consideration of how data should be collected, and a culture that talks about data but doesn’t use it day-to-day.

We all need to take a hard look in the data mirror and ask ourselves if we are suffering from info-besity or info-rexia?

Data Cleaning and Enhancement

In the automotive and heavy-duty industries, the adoption of AI for data cleaning and auditing processes marks a transformative shift. Historically, these sectors have grappled with resource-intensive and laborious manual data management, making it a formidable challenge for organizations.

AI, armed with advanced algorithms and machine learning, now plays a pivotal role in streamlining the arduous task of data cleansing and management. It swiftly identifies and rectifies inconsistencies, errors, and outliers within extensive datasets, saving valuable time and resources.

This not only addresses resource constraints but also ensures that the data used for critical analysis and decision-making is consistently accurate and reliable, which is imperative in industries where precision is paramount, such as the automotive and heavy-duty sectors.

Moreover, AI’s impact transcends mere automation, extending to data enrichment by generating missing values and completing fragmented datasets. This enhancement results in more comprehensive and holistic data, offering a superior user experience and building trust with customers.

In a data-centric landscape, where accuracy and reliability are non-negotiable, organizations can leverage AI-driven data management to gain a competitive edge. Pivotree, a leading player in this domain, empowers organizations to harness the potential of clean, reliable, and enriched data, enabling them to make more informed decisions and excel in industries where data quality is of paramount importance, ensuring the right part is sold and meeting customer demands efficiently.

Personalized Customer Experiences

AI-powered recommendation engines can revolutionize how we engage with our customers, offering tailored suggestions based on comprehensive customer data analysis. This game-changing technology applies to both B2C and B2B sectors, delivering a personalized experience that fosters higher customer satisfaction, brand loyalty, and trust.

Beyond recommendation engines, Generative AI has the potential to make waves in how we view customer support by automating more personalized responses to inquiries, thus streamlining the efficiency of customer service operations and building up the more personalized customer relationship.

Supply Chain Optimization

AI is making a profound impact on the optimization of supply chains. Gone are the days of relying solely on intuition and historical data; AI enables organizations to revolutionize their supply chain operations.

With the power of AI, companies can generate precise demand forecasts that respond to current market conditions and anticipate future trends, giving them a strategic edge.

Moreover, it can proactively identify potential disruptions, whether they stem from unforeseen events or supply chain bottlenecks, recommend intelligent inventory management strategies, optimize stock levels, and reduce carrying costs, allowing businesses to swiftly adapt and minimize the impact of disruptions in the automotive aftermarket industry.

AI is a powerful tool that can strategically help this industry unlock the true value of their data and meet the increasing demand for better data. By automating data cleaning, enhancing data quality, and generating actionable insights, organizations can deliver more meaningful experiences to their customers while eliminating the clutter of irrelevant data.

This technology accelerates the industry’s journey towards data-driven innovation and customer-centricity, ultimately giving trust to the end consumer.

Source:DgitalDealer

Cars keep costing more, and dealers keep paying less

Posted Monday, April 1, 2024

Car values are plummeting so now a lot of people are underwater on their car loans

Every year, the price of a new car ticks ever upwards. Loans get longer, yet monthly payments are always on the rise, leading to an epidemic of folks underwater on their loans. Now, there’s a new complicating factor: Used car prices are falling, meaning folks are getting less for their over-leveraged trade than ever.

A new report from Edmunds looked at used car prices compared with trades that have negative equity and found that a drop in the former has led to a steep rise in the latter. According to the report, this isn’t even unexpected — it’s a natural progression from the lockdown-era used car boom. From Edmunds:

“A storm is brewing in the used market as incentives and inventory continue to trickle back into the new vehicle market,” said Ivan Drury, Edmunds’ director of insights. “With demand for near-new vehicles on the decline, used car values are depreciating similarly to the way they did before the pandemic, and negative equity is rearing its ugly head.”

“During the last few years, consumers could jump into new car loans and their trade-ins were shielded from negative equity because some dealers, desperate for used inventory, were willing to pay near original purchase prices,” said Drury. “These days, consumers need to be more careful — especially if they’re trading in newer vehicles — because near-new cars are being hit the hardest by depreciation.”

An actual flying car is one step closer to reality

Posted Monday, April 1, 2024

The AirCar idea is taking flight again. This time, it's no 'test flight' or 'certificate of airworthiness'. The technology is actually being licensed for production. That's right. Flying cars are closer to reality than ever before...

KleinVision, the Slovakian developer of the first ‘certified’ flying car, has signed a manufacturing agreement with Hebei Jianxin Flying Car Technology.

We don’t know how much the deal is worth, but we do know that the licence gives Hebei Jianxin exclusive access and distribution rights to KleinVision’s suite of airborne auto innovations. The agreement does however limit production geographically – we presume that means to Chinese airspace only.

If aeroplanes are buses of the skies, the AirCar is set to put the wind beneath individual drivers’ wings. It'll then retract those wings once landed and let said drivers get on their journey more conventionally. It’s all very Jetsons-esque, albeit powered by a 160bhp BMW engine – though it's probably not arriving any time really soon. Stuff like runaways and air traffic control approval protocol will need ironing out.

Source: Topgear

What's New -March 2024

Posted Friday, March 1, 2024

Sales

New Sales- The mouse-over tooltip will display the minimum price when you hover over the Sale Price label on line 3 of the deal screen

Sale Tax Rates-In some states such as California, sales tax rates are determined based on the customer's address. We encountered a case where the customer's address was initially linked to an 'Unincorporated' jurisdiction on the sale date but later linked to the correct city tax rate. To assist dealers for such rare occurrences, a new button has been added to the pop-up window of line 1 Zip, labeled 'Re-check Tax Rate,' to confirm whether the tax rate still matches the sale date.

Texas Dealers- System increases the DMV fees for $200 when selected in the sales tab, when vehicle is marked as EV in the inventory tab, line 18. This is per Senate Bill 505, passed by the Texas Legislature. This link offers more information.

WA Dealers- The system will adjust the Sales Tax amount due from a customer who purchases an EV or Hybrid Plug-in when it meets the WA New clean alternative fuel and plug-in hybrid vehicle sales and use tax exemption criteria. You can click on this Link to learn more about it.

In summary, the system will offset the taxable amount if the sales price meets the guideline and the vehicle is added to inventory as Electric or if the Model/Submodel has 'Plug-in' in its description. Additionally, we have added a report that you can assign to your report list. Simply search and assign 'WA Electric Vehicle Tax Credit Export'. We encourage you to create a sample deal both with and without trade or accessories to ensure that you are in agreement with the sales tax amount shown by the system.

Bookeeping

Financed Loans Tab-A new feature has been added to help reduce potential ePayment customer disputes. When your staff attempts to process an ePayment, in the final stage of saving the payment, the system will prompt a CVV code each time it is sent to obtain approval. Depending on the payment gateway used during the account setup, this feature may not be visible for some clients.

CA Dealers-ASN updated the PID-1 vendor name from 'State Board of Equalization' to 'California Department of Tax and Fee Administration (CDTFA)'. This change is aimed at removing any confusion, as California tax revenue is mostly associated with the new name.

History Tab- The updated 8300 Form is now available in the Payment History for customers whose payments meet the IRS requirement.

Inventory

A new Pack System has been introduced for inventory tab, line 65. You will now have the ability to use a min/max vehicle cost and set multiple packs. To explore this feature, navigate to Settings, Miscellaneous Defaults and click on the blue arrow on line 2. For further guidance, you can learn more about this feature by visiting the FAQ help page (accessible via the ? on the tab label) and searching for 'How can I change our default PACK?' At the bottom of the instructions, you will find a link to a video tutorial for implementing a multi-tier Pack system.

Collateral Management tab- There is a new Archive option is added to preview mode of "Repo Order".

Reports

We've incorporated several new data fields based on requests from different users.

Contracts

OR Dealers-The DMV 735-500, the power of attorney form is added for Trade 1 & 2

NC Dealers- The POA MVR-63, the power of attorney form is updated to newer version avilable.

Several other forms have been updated to align with the requirements of the client's State form. If you're aware of any forms for which you don't have the latest version, please don't hesitate to send a TSM so we can investigate and ensure you have the most up-to-date versions.

Vehicle Disclosures Form- A new feature has been added to allow for custom Spanish translations of English disclosures. To access this feature, go to Settings > Miscellaneous Defaults and click on the blue arrow on line 7 for Vehicle Disclosures. This will open a pop-up window where you can edit, remove, or add new disclosures. When adding a new disclosure, you have the option to use the 'Translate English to Spanish' button or enter your own translation for future use. These translated languages will be printed on the vehicle disclosure form when Spanish is selected as the language in the contract screen.

Shop

A new feature, Shop Advisor Line 28, has been added for shops section in RO screen. You may have both a part manager and Sales/Service writers and, if so, you can now assign them to each Repair Order (RO). This new field can be left blank if not needed. Additionally, the Service Advisor field has been included in the Custom Report for 'RO Details' as a report source to assist with your reporting needs.

CRM

Digital Recon-If you are actively using the Digital Recon feature, opening your Digital Recon link from the CRM home page will also display the last note from the Tech inspection below the VIN info. This additional information, along with vehicle info, Age, Recon Status, and Tags, can expedite your recon process and enable quicker authorization for your shop staff.

Highlights:

ASN Menu- For those of you taking advantage of the ASN Menu system, we'd like to remind you that you have the option to customize your Tier names. ASN offers 4 Plan Tiers, one of which is based on questionnaires and is called 'Driver Needs', representing the minimum offering setup. Please don't hesitate to send a TSM to learn more about the Menu feature in AutoDealer Plus.

Latest Update is Version 7.0.17.49

Prohibited Practices

Posted Thursday, February 29, 2024

The CARS Rule prohibits misrepresentations about material information. The CARS Rule requires dealers to clearly disclose the offering price – the actual price anyone can pay to get the car. The CARS Rule makes it illegal to charge consumers for add-ons that don't provide a benefit.

Here are the list of things dealers and their staff should be aware of:

Blank, Signed Documents

No documents are to be signed in blank with the understanding that the terms will be filled in later.

Cash Back to Customer

Cash back to a customer from the dealer is generally considered to be a violation of the dealer-lender agreement and potentially bank fraud.

Completing Documents After the Fact

All documents presented to the customer for signature must be fully completed before obtaining the customer’s signature.

Credit Card Down Payments

Most dealer-lender agreements prohibit borrowed down payments, and a down payment on a credit card is considered borrowed. Some exceptions apply.

Falsifying Information to Finance Sources

Providing false or misleading information to finance sources to obtain a credit approval is a violation of the agreement executed between the dealer and the finance source.

Forging Customers’ Signatures

Forgery is a crime.

Front-End Improvement

Front-end improvement is the practice of increasing an already agreed upon vehicle sale price.

Including Undisclosed Voluntary Protection Product Price

The salespeople are to sell the vehicle only. The F&I manager is to sell ancillary Voluntary Protection Products. Salespeople are not to include ancillary Voluntary Protection Products in any price quote.

Inconsistent Product Pricing

The pricing of VPP products must be consistent on all forms. These documents comprise the paper trail and include the menu, buyer’s or lease order, the Retail Installment Sales Contract or lease agreement, and the product enrollment forms.

Kicking the Trade

This deceptive practice occurs when a customer owes more on the trade vehicle than the vehicle is worth. The salesperson does not believe they can obtain a credit approval with the amount of the prior loan balance and remove the potential trade from the deal. The customer is then encouraged to return the potential trade vehicle to the lien holder after the deal on the dealer’s vehicle is funded.

Menu Manipulation

Any manipulation of the other fees, trade allowance, cash down payment, days to first payment, or purchase price, to artificially inflate the base monthly payment is forbidden.

Missing Enrollment Forms

Customers must sign enrollment forms for every product purchased.

Payment Packing

This practice occurs when a payment quoted is more than the actual payment required to purchase the vehicle for the price agreed upon at that point in the negotiation.

Photocopy Military ID

It is a violation of a federal statute to make a photocopy of a military identification card.

Power Booking

This is the practice of showing nonexistent options to finance sources to artificially inflate the value of the vehicle.

Product Stuffing

Product stuffing occurs when a product is included in the amount financed/capitalized cost without the customer’s knowledge or consent.

Scooping Rebates

This practice occurs when the dealership does not disclose or include an available consumer rebate as a reduction to the amount financed/capitalized cost, and absorbs the rebate into profit.

Shotgunning Multiple Vehicle Purchases

Shotgunning occurs when one person signs or cosigns for multiple vehicles within a short period of time without the finance sources’ knowledge.

Signature on File

The customer’s signature is to be obtained on all applicable documents. “Signature on file” or any other such designations are not permitted.

Straw Purchases

This is a specific form of falsifying information to finance sources. It occurs when the person who is purchasing and driving the vehicle is not a party on the retail or lease agreement.

Trading Rate for Product

Once the APR has been agreed upon, it cannot be lowered to facilitate the sale of ancillary after-market or Voluntary Protection Products.

Yo-Yo Transactions

This type of transaction is one where the customer is spot-delivered on a deal structure that the dealership does not reasonably expect any financial institution to purchase, then brought back to recontract on a new transaction that they may not have accepted when first negotiating the deal.

THE SADR LAW FIRM GETS HIT WITH $1.2M JUDGMENT

Posted Thursday, February 29, 2024

A PLAINTIFF’S ATTORNEY BECOMES A DEFENDANT:

One of the largest consumer law firms in the state specializing in suing car dealerships under the Consumer Legal Remedies Act for selling vehicles with undisclosed “frame damage” was just hit with a judgment of $1.2 million after a trial in Los Angeles. Judge Jon R. Takasugi awarded the Plaintiff, Hawthorne Auto Market, Inc., $200,000 in general and special damages, and $1 million in punitive damages in its defamation and contractual interference case against Sadr.

ALG obtained a transcript of the March 22, 2023 hearing where Judge Takasugi reviewed the evidence, ruling that Sadr’s business model “teeters on a razor’s edge of ethics.”

The Sadr Law Firm, alternatively called The Car Law Firm, and its principal attorney and founder, Kasra Sadr, has long been the bane of used car dealers throughout California. There has also long been speculation about how Sadr obtains information from Manheim and the personal contact information of buyers. According to the Hawthorne Court, the primary problem found with the boilerplate solicitation letters is that “they cause an average reader to believe that their car is in imminent danger” and the solicitation letter in this case “is inflammatory and designed to cause panic in the general population.”

The next hearing is set for June, for approval of the proposed judgment, and a determination of whether the judgment will apply to Sadr individually, or his law firm, or both. It is unclear at this time whether Sadr will appeal.

The question now is: Will Sadr revise his business model in the wake of this judgment? With that kind of liability exposure from just one case, one would hope so, but time will tell.

T-Mobile Will Soon Fine Some Third-Party Messaging

Posted Thursday, February 29, 2024

Beginning on January 1st, 2024 T-Mobile is implementing a strict penalty fee structure for compliance violations for messages sent on their network. These fees will be directly passed on to you. As always, it is your responsibility to ensure that all your campaigns and messages follow all relevant messaging best practices, guidelines, and regulations.

The T-Mobile non-compliance fines will be passed on according to the following tiers:

Tier 1: $2000 USD, for phishing, smishing, social engineering.

Tier 2: $1000 USD, for illegal content (must be legal in all 50 states and federally).

Tier 3: $500 USD, for all other violations including but not limited to SHAFT.

"Social Engineering" means all techniques aimed at getting a target to revealing specific information or performing a specific action for illegitimate reasons. Examples include but not limited to phishing, smishing, and pretexting purporting to be from reputable companies in order to induce individuals to reveal personal information, such as passwords or credit card numbers.

"Illegal Content" Refers to any content that is not legal in all 50 states and federally. This list is outlined in the T-Mobile Code of Conduct section 5.1 "Unlawful, Unapproved or Illicit Content" (however not limited to) includes Cannabis, Marijuana, and Adult Solicitation.

5.1 Unlawful, Unapproved, or Illicit Content

No messaging programs can run on the T-Mobile network that may promote unlawful, unapproved, or illicit content, including but not limited to:

- SPAM

- Fraudulent or misleading messages

- Depictions or endorsements of violence

- Inappropriate content

- Profanity or hate speech

- Endorsement of illegal drugs

Programs must operate according to all applicable federal and state laws and regulations. In addition, the content must be legal across all 50 states. All content must be appropriate for the intended audience. Additional legal and ethical obligations apply when marketing to children under age 13, and such programs might be subject to additional review by T-Mobile.

"All Other Violations" refers to Subsection 5.7 of the T-Mobile Code of Conduct, which outlines, but is not limited to "Age Gating"

5.7 Age Gating

T-Mobile may, at its discretion and at any time, suspend, terminate, or not approve any Messaging Program it feels does not promote a legal, age-appropriate, or positive customer experience. All content must adhere to all applicable laws and support a functioning age gate when associated with but not limited to Sex, Alcohol, Firearms, Tobacco, and/or any other age-restricted content that must comply with legal regulations. Nonacceptable age gating function includes but is not limited to Yes or No responses. The age-gate mechanism should include the date of birth verification during the consent opt-in of the consumer.

If T-Mobile determines that a Violation continues and is excessive during the Term of the Agreement, T-Mobile reserves the right to permanently suspend brand, campaigns, and or Company’s access to the T-Mobile Network or the Company Connection.

Record 1.2 Million EVs Sold in U.S. Last Year

Posted Thursday, February 29, 2024

A record 1.2 million U.S. vehicle buyers chose to go electric last year, according to estimates from Kelley Blue Book released Jan. 9.

Specifically, 1,189,051 new electric vehicles (EVs) were put into service as the slow shift to an electrified future continued unabated. In 2023, the EV share of the total U.S. vehicle market was 7.6%, according to Kelley Blue Book estimates. That is up from 5.9% in 2022.

Digging into the EV Data

EV sales in the fourth quarter set a record for both volume and share: 317,168 and 8.1%, respectively. And while records were set, the oft-reported slowdown is real. Q4 EV sales increased year over year by 40% – a strong result by any measure, except when compared to the growth the industry saw in previous quarters. The market posted a 49% gain in Q3, and EV sales were up 52% year over year in Q4 2022. By volume, EV sales in Q4 were higher than in Q3 by about 5,000 units. The EV market in the U.S. is still growing, but not growing as fast.

The Cox Automotive Economic and Industry Insights team is calling 2024 “the Year of More” when it comes to EVs. More new product, more incentives, more inventory, more leasing, more infrastructure – all the more will combine to push EV sales higher in the year ahead. The team forecasts EV share of the U.S. market in 2024 will reach 10%.

According to December transaction price data shared during the Cox Automotive Industry Insights Webcast early in January, transaction price parity between internal combustion engine vehicles and EVs looks more realistic in the coming years.

Still, EVs remain expensive. Last month, the average price paid for a new EV was $50,789, according to Kelley Blue Book estimates. Shifts in tax incentives will both help and hurt buyers in the year ahead – fewer vehicles now qualify, but the ability for dealers to apply any tax credits at the point of sale will help. Generally speaking, shoppers are still hard-pressed to find a new EV with a manufacturer’s suggested retail price below $40,000. In fact, there were two last month: The Chevy Bolt and Nissan Leaf.

Tesla remains the undisputed champion of EV sales in the U.S., capturing 55% of the EV market in 2023. That’s down from 65% in 2022, but lower prices are clearly fortifying the company’s position. Tesla’s share increased in Q4 after falling to an all-time low in Q3. Notably, the Model Y accounted for 33% of all EVs sold in 2023. Tesla’s share of the total U.S. market reached an all-time high of 4.2% in calendar year 2023, a number that was not lost on Tesla boss Elon Musk and his humor. Tesla outsold VW, Subaru and others in 2023.

The German luxury brands have all lost share to Tesla over the past five years, but new products are certainly attracting luxury EV buyers back to the traditional Bavarian nameplates. Last year, 12.5% of BMW sales were EVs. Audi and Mercedes also increased their EV sales, which now account for 11% and 11.5% of total brand sales, respectively. Nearly all automakers should see their share of EV sales increase in the year ahead, and those not currently in the game will jump in.

Still, in the automobile business, nothing happens quickly. EV growth will continue to slow, and in the year ahead, we may even report the first quarter-over-quarter sales decline in more than three years. Regardless, the Cox Automotive Industry Insights team is forecasting more growth in the EV market. The momentum is there and is not going away.

EV Prices End Year Down 18% Since January 2023

In December, EV incentives reached their highest point of 2023 at 10.6% of ATP. A year ago, EV incentives were less than 2% of ATP.

Thanks mostly to significant price cuts from Tesla, average EV prices in December were down 17.7% from January 2023. EV sales in the U.S. reached a record 1.2 million units in 2023, up 46.3% from 2022, according to estimates by Kelley Blue Book.

“2023 was a milestone year with 1,189,051 pure battery electric vehicles sold, accounting for 7.6% of all new-vehicle sales,” said Stephanie Valdez Streaty, director of Industry Insights at Cox Automotive, in a news release. “Last year’s main story was Tesla price cuts that shook up the market and challenged the profitability picture for all automakers. Tesla is by far the dominant force in electric vehicles – when they cut prices, everyone takes notice.”

Dealers Are Dropping Prices

Posted Thursday, February 29, 2024

Car Dealers Have So Much Inventory That They're Dropping Prices

New car prices are on the decline as the highest inventory levels in years force dealers and automakers to reduce their margins.

The average price of a new vehicle was $47,401 in January, which is a 2.6% drop from the average price in December of $48,652, according to Kelley Blue Book data.

New car prices are also down by 3.5% compared to a year ago. In January 2023, the average price was $49,125, making this decline noteworthy as new car prices almost always rise year over year.

“Prices have been trending downward for roughly six months now as automakers are sweetening deals to keep the sales flowing,” Erin Keating, executive analyst for Cox Automotive, said in a report.

In other words, car prices are falling as the number of cars on dealers’ lots rises. New vehicle inventory currently stands at 2.66 million units, according to Cox data, which is a 49% increase in the past year.

Increased vehicle production and relatively low buyer demand are the main factors leading to the rise — and discounts to lure in buyers. For example, qualifying customers can get up to $7,850 cash back on certain 2023 Dodge Durango models.

Despite the recent decline in average transaction prices, car prices are still up nearly $11,000 since January 2020. Auto loan rates are also higher, which means affordability remains a major issue for America's drivers.

The average auto loan rate on a new vehicle is 9.68%, only slightly lower than the recent peak of 9.95% recorded in mid-October (which was the highest level in at least five years). In fact, experts say many would-be buyers are waiting to shop for their next car until financing options improve.

“With rates higher so far this year, the consumer has limited sense of urgency right now other than cash in hand,” Jonathan Smoke, chief economist at Cox, said in a separate report Tuesday.

For buyers with good credit scores, it’s still possible to find a low-APR financing deal, especially if you’re shopping for a less-in-demand vehicle. Per Cox, more than 13% of car buyers are securing APRs under 3%.

In the used vehicle market, prices are also down from last year. The average list price was was $25,328 in January, which is 4% lower than a year ago, according to Cox. But used auto loan rates are even higher than they are for new vehicles, and a recent report from car ownership app Jerry found that most American households can't even afford the average used car.

Source: Money.com

What's New -Feb 2024

Posted Thursday, February 1, 2024

Inventory

On the Inventory/Edit Screen, if you have the appropriate security clearance #935, labeled as Global Price Change, you'll notice a gear icon in the top section. If you click on it, the third selection is a new feature called 'Automated Pricing Rules'.

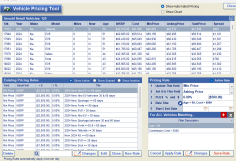

Automated Price Tool: Your Inventory Pricing Solution

-

What is it?

Our Automated Price tool empowers dealers to take control of their inventory pricing effortlessly.

-

Key Features:

- Adjust Asking Price, Sales Price, and Minimum Pricing.

- Base adjustments on Commissionable Cost or other pricing tiers.

- Choose percentage or flat increase/decrease amounts.

- Set rules based on filters like inventory aging or specific stock criteria.

- Apply rules with ease and see immediate results.

- Monitor profit changes and visualize inventory adjustments.

-

Why it Matters:

With our tool, dealers can streamline pricing management, ensure competitiveness, and maximize profitability.

-

How to Get Started:

Simply access the feature through our platform and begin setting rules tailored to your dealership's needs.

Take control of your pricing strategy today with our Automated Price tool!

Shop

Labor Lines Coloring indicators:

If you use a CRM for your shop and technician assignments, the following information can help you identify whether your technicians are properly logging their work in the CRM app. When looking at a labor line, you can also notice that the background color can be 3 colors:

Green which indicates the tech completed the work.

Yellow indicates the tech worked/logged some time, but has not completed it

White which indicates no work has been logged.

Part Advsor Field:

Reports

We've incorporated several new data fields based on requests from different users.

Contracts

Several forms have been updated to align with the requirements of the client's State form. If you're aware of any forms for which you don't have the latest version, please don't hesitate to send a TSM so we can investigate and ensure you have the most up-to-date versions.

Highlights:

Dealers whose ASN interfaces facilitate accessory sales may encounter situations where a plan is not offered or visible in the plan list upon opening the pop-up in line 4 of the sales contract. If the user clicks on 'Rest Plans' and still does not see a qualified plan, they can click on a line at the bottom of the screen that reads 'Some Accessories not Available for this Vehicle'. This confirms what is not offered, and if you believe this to be an issue, you may wish to discuss it with your agent.

The new 1099 MISC (2023) and 1099 NEC (2023) are updated in the history tab.

Forms 1099-MISC, Miscellaneous Information and Forms 1099-NEC, Nonemployee Compensation, are also due to taxpayers by January 31. The filing due date for Forms 1099-MISC is February 28, 2024, if filed by paper, and March 31, 2024, if filed electronically. 1099-MISC copies with no data in boxes 8 or 10 are due to recipients by January 31, 2024. If the forms contain data in boxes 8 or 10, the deadline is extended to February 15, 2024.

Latest Update is Version 7.0.17.42

2024 Average Car Payments for New and Used Cars

Posted Thursday, February 1, 2024

The Average Car Payments for New and Used Cars in 2024

As with almost everything else, car payments became

much more expensive in the last year, and 2024 isn’t looking any better. Consumer Reports explained that

the car market has become increasingly complicated because of continued disruptions to manufacturing, buying habits and unstable personal finances as a result of the COVID-19 pandemic.

These issues have all resulted in measurable increases in car costs across the board. 40-year record high inflation is also to blame, with auto loan interest rates reaching their highest levels in decades.

Increased Car Costs Heading Into 2024

Car payments are up heading into 2024, whether you’re looking for a new or used vehicle for purchase or lease. Overall, the cost of having and keeping a car has never been more expensive:

- LendingTree reported that the average car payment for new vehicles was $726 per month as of Q3 2023. That’s a 3.6% ($25) increase from Q3 2022, when the average car payment was $701 per month.

- At the same time, the average car payment for new vehicle leases was $597 per month as of Q3 2023, a comparable 4.6% ($26) increase from Q3 2022, when the average car payment was $571 per month.

- The average car payment for used vehicles was $533 per month as of Q3 2023, which is a 0.8% ($4) increase from Q3 2022, when the average car payment was $529 per month.

It remains to be seen what the cost of these same payments will be towards the end of 2024.

Auto Loan Statistics in 2024

Here are some important stats to better understand the current car market in 2024, according to a recent press release from the Federal Reserve Bank of New York as well as their Q3 2023 Household Debt and Credit Report:

- Total American Auto Loan Debt Has Reached About $1.595 Trillion: According to the Federal Reserve Bank of New York, overall vehicle debt has increased by 88.8% over the last 10 years. That’s an increase from $845 billion in Q3 2013 to $1.595 trillion in Q3 2023. Americans are now spending more on vehicles than ever before.

- Auto Loan Debt Increased By $71 Billion Year Over Year: From Q3 2022 to Q3 2023, there was a $71 billion increase in auto loans in the United States, resulting in the total American auto loan debt noted above.

- 2.53% of Borrowers Reached Serious Delinquency On on Their Auto Loans As of Q3 2023: From Q3 2022 to Q3 2023, the number of borrowers who flowed into serious delinquency (90 days or more delinquent) increased from 2.02% to 2.53%. This represents about a 20% increase in borrowers who became delinquent on their auto loan payments year over year.

- Median Credit Score of Newly Originated Auto Loans Increased To 719 From 716: The median credit score of auto loan borrowers increased by 3 points year over year.

Source: GOBANKINGRATES

Higher Consumer satisfaction with car buying

Posted Thursday, February 1, 2024

Consumer Satisfaction With Auto Dealers Jumped 8% Last Year

A new survey shows car buyers are increasingly happy with their dealers at a seven out of ten rate.

Cox Automotive’s annual Car Buyer Journey (CBJ) Study released Jan. 17 revealed satisfaction with the overall vehicle shopping and buying experience improved in 2023 after declining the two previous years.

The CBJ survey offered that improved inventory levels, the return of discounting, and a further proliferation of an omnichannel approach combining online and at-dealership activities produced a higher level of satisfaction.

Better then 2022

Overall, 69 percent of consumers reported being highly satisfied with the process compared to 61 percent in the 2022 study. Respondents offered heightened product availability, the return of incentives, and a continued shift toward a more digital process were the main contributing factors.

Additionally, overall vehicle buyer satisfaction increased to 68 percent from 58 percent. New-vehicle buyers reported a 73 percent satisfaction rate, up from 70 percent the previous year.

Retail outlets, specifically dealerships, continue to deliver an overwhelmingly level of satisfaction. In 2023, 74 percent of all vehicle reported elevated satisfaction levels with their dealership experience.

New Deal Happiness

Satisfaction with the retail experience among new-vehicle buyers matched an all-time high of 79 percent, equal to the level reached in 2020. Among the interactions garnering the highest praises were the test drive experience (82 percent), vehicle pickup and delivery process (79 percent), and interaction with the sales team (77 percent).

“There is an often-cited narrative that suggests going to a car dealer is worse than a root canal,” said Isabelle Helms, vice president of Research and Market Intelligence at Cox Automotive in a press statement. “Our research and data, however, suggest that this is simply not the case.”

The 2023 survey results were derived from nearly 3,000 consumers who bought a new or used vehicle in a 12-month period ending August 2023. The survey was conducted in August and September 2023.

Buyer Demographics

In the report, 68 percent of buyers considered both new and used vehicles, up from 64 percent in the previous report; 78 percent of used-vehicle buyers considered a new vehicle during the shopping process.

The survey found purchase in the U.S. continues to be driven by households with above-average incomes: The average household income (HHI) in the survey period for a new-vehicle buyer was $115,000 and was $96,000 for a used-vehicle buyer.

Meanwhile, electric vehicle (EV) buyers were notably younger than average (41 years old versus 52 for all new-vehicle buyers) and higher earners (HHI for an EV buyer was $140,000).

Deeper Investigation

Buyers typically considered two vehicles and visited two dealerships.

Nearly 80 percent of shoppers visited a third-party website during their buying journey (e.g., Autotrader, CarGurus, Edmunds.com, or Kelley Blue Book).

EV buyers were more likely to visit third-party sites, particularly first-time buyers. The report also reveals that fewer shoppers visited automaker websites or used online retailers compared to 2021 and 2022.

Merging Online, Brick-and-Mortar

When it comes to car buying in America, the desired state is omnichannel as only 7 percent completed every step online in 2023. The survey found 43 percent completed steps in a mix of online and at the dealership, and 50 percent completed all the steps in person. Used-vehicle buyers were more likely to cite in-person as the solution.

The interaction online has led to less time in the showroom as new buyers reported spending approximately 11 hours and 45 minutes from beginning to end, down more than 80 minutes from the prior year. And used-vehicle buyers reported spending more than 14 hours, a one-hour decrease.

Vanessa Ton, senior manager of Market and Customer Research, commented that dealerships that fully embrace an omnichannel approach are the most successful, as the process becomes more efficient for everyone involved and delivers happier buyers.

“Year after year, our studies suggest that consumers are not pursuing an entirely digital experience,” said Ton. “Rather, we believe car buyers want a seamless experience where they can start the process at home, shop, fill out any required forms, and then go to the dealership, test drive a car, complete the deal, and learn about their new purchase.”

Source: Digital Dealer